2022 brought pressure for both the direct selling industry and sellers—pressure with no singular cause, yet pressure that loomed heavily over the global landscape.

Gains realized during the pandemic era started to normalize, while global inflation brought about obstacles and opportunities. Increasing competition from a widening array of income opportunities like home delivery, ride-sharing and other gig-driven employment applied increasing pressure to the direct selling channel.

Yet, the World Federation of Direct Selling Associations, celebrating its 45th anniversary with a publication called WFDSA Stats, reported, “Overall, the global retail sales landscape has demonstrated resilience and positive growth during the above mentioned period, showcasing the industry’s ability to adapt and flourish even amidst challenging circumstances.”

As has been our tradition for 13 years, Direct Selling News once again utilized the painstaking global industry statistics offered up by WFDSA to create a synopsis of the state of the global direct selling industry and list the Billion Dollar Markets.

So, what does WFDSA’s global survey show for 2022? The overall global trend remains positive for the direct selling industry despite a slight dip in last year’s global sales. WFDSA cites three consecutive years of global sales growth and 2022 sales that surpassed both the pre-pandemic level of $168,117 million ($168.1 billion) in 2019 and 2020 pandemic sales of $172,147 million ($172.1 billion) as evidence.

These gains and optimism hold true with or without the inclusion of China, whose turbulent industry conditions and statistical inclusion impacts global sales figures. In 2022, China continued to experience widespread lockdowns and a governmental zero COVID policy.

While post-pandemic pressure is easing, members of the Asia/Pacific region anticipate another challenging 12-24 months, Jeoff Mulham, President of the Australian DSA noted in WFDSA Stats.

Direct selling regional market sales across the world mirrored global economic performance in 2022. Sukanda Chunhachatrachai, head of DSA Thailand, told WFDSA Stats, “Despite a decrease in sales, many companies have responded by quickly adapting to new trends and making good use of tools like social media, digital marketing and online marketplaces.”

DSA member companies in Germany reiterated the importance of adaptability during a time of heightened global political tensions, an energy crisis and supply chain disruptions. 2022 was a time for creative thinking, and it seems Europe’s direct selling industry fared better than that region’s ecommerce, which declined by 7.5 percent, Frederic Billon, Secretary General of the French Direct Selling Association, noted.

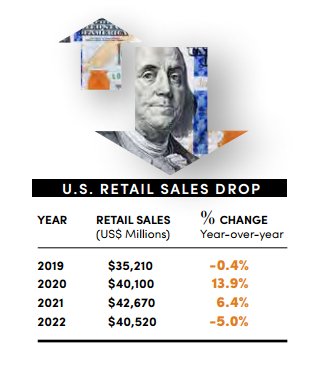

“Per the USDSA, direct selling fared better than some sectors and not as well as other sectors resulting from numerous factors, but what is clear is that direct selling revenue remains higher than the levels reported in pre-pandemic 2019. This is an important indicator of the vibrancy and resilience of the direct selling channel. Not unlike the economy in general, direct selling is still adjusting to the buying patterns and consumer expectations patterns in the post-pandemic economy,” WFDSA reported.

The Data

Note: All WFDSA data have been rounded throughout.

WFDSA reports global estimated retail sales of $172.8 billion (Constant US Dollars) for 2022, a decrease of 1.5 percent under 2021.

This figure reflects the global marketplace including the volatile China market. However, it has become WFDSA practice to offer up dissected totals that eliminate the volatility of the China market. Therefore, excluding China, global estimated retail sales for 2022 were $157.3 billion. Sales between 2019 and 2022 jumped 9.4 percent with a three-year compound annual growth rate (CAGR) of 3 percent for that period.

Regional sales performance in 2022 consistently lagged behind 2021. Estimated retail sales in The Americas were down 3.2 percent. Europe as a whole fell 1.1 percent, as did Africa/Middle East with a decline of 13.3 percent. South and Central America emerged as a regional bright spot experiencing growth of 2.5 percent, and Asia/Pacific kept steady up 0.2 percent.

The status of the global industry, as measured by the three-year CAGR showed a decline of 1.5 percent for the 2019-2022 timeframe and follows a static growth rate in 2020.

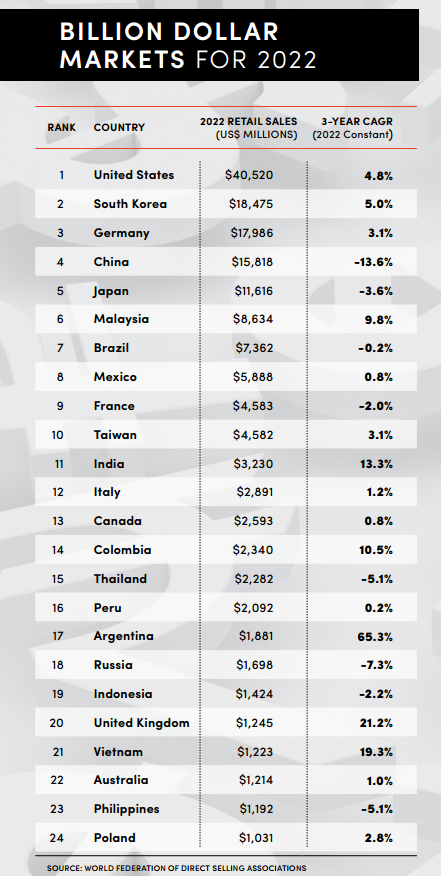

Very little positional shifting took place in the largest of the Billion Dollar Markets in 2022; however, there was minimal movement in the lower rungs. Three of the top five Billion Dollar Markets struggled with the United States, China and Japan all experiencing losses. Rounding out the top five, South Korea and Germany posted growth of 7.4 and 6.6 percent, respectively. Beyond the top tier, 2022 proved a tough year for smaller Billion Dollar Markets, too. Russia, United Kingdom and Canada registered near or above 20 percent losses. Significant growth was rare, but was seen in Vietnam, Argentina, Colombia, Malaysia and India.

Of the 24 Billion Dollar Markets, the United States leads global retail sales at 23 percent of the global market, followed by South Korea, 11 percent; Germany, 10 percent; China, 9 percent; Japan, 7 percent; Malaysia, 5 percent; Brazil, 4 percent; Mexico, 3 percent; France, 3 percent; and Taiwan 3 percent. All other reporting markets comprise the remaining 22 percent of global sales.

WFDSA reports nearly five million fewer independent representatives participated in direct selling worldwide in 2022 than in 2021. All told, 114.9 million participated in 2022. But this number represents a return to pre-pandemic levels after millions rushed to join the industry in 2020 and 2021. Global Sales Representative growth remains flat between 2019 and 2022. With the exclusion of China, however, slight growth of 1.1 percent was seen during this time.

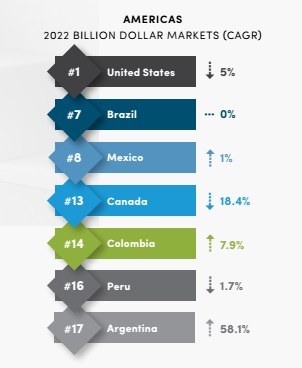

The Americas

The Americas—North and South/Central—reported a combined $65.2 billion in estimated retail sales in 2022. While this region experienced a fall of 3.2 percent in year-over-year sales, the three-year CAGR held strong at 4 percent. The Americas represents 38 percent of global direct selling sales.

Seven Billion Dollar Markets are included in the North and South/Central America region. Wellness and Cosmetics run nearly even in their product category popularity at 29 and 27 percent, respectively. Household Goods and Durables remains third at 13. Nearly 29.9 million independent representatives affiliated with direct selling brands in 2022. That’s a drop of some 2.5 million people.

Regional data for the Americas reported together. However, the Americas are split here to better understand each of the distinct markets.

North America

After two years of pandemic conditions that drove sales skyward, 2022 brought a post-pandemic normalization and decline of 6 percent to North America as it posted $65.2 billion in sales with a year-over-year loss of 3.2 percent.

US global sales share remained at 23 percent, and the $40.5 billion in sales generated solidified its number one ranking in the world marketplace. While year-over-year sales dropped by 5 percent, the US CAGR is 4.8 percent.

Canada’s pandemic-era sales growth of 26 percent posted in 2020 all but slipped away with 2021’s flat performance and 2022’s decline of 18.4 percent. Nearly $2.6 billion in sales posted in 2022 with a CAGR of 0.8 percent.

Cosmetics gained ground as a product category of choice, leaping from 14 percent in 2021 to 35 percent in 2022. Wellness followed closely at 34 percent and Household Goods and Durables at 18 percent.

Independent representative numbers for North America continued their decline following pandemic highs with a regional total of 15.7 million independent representatives. 14.6 million partner with companies in the United States and 1.1 million in Canada.

South/Central America

The South/Central America countries of Brazil, Mexico, Colombia, Peru and Argentina told a mixed story which included high-end sales performance, flat lines and losses.

Argentina continues its trend of top-end sales growth and posted a 58.1 percent increase. While it’s important to note the highly inflationary aspects of Argentina’s market, these increases continue to stand out and represent a country CAGR of 65.3 percent. Colombia’s growth was also notable at 7.9 percent. After Brazil experienced a sizeable downturn in sales performance in 2021, losing nearly $800 million in sales, 2022’s statistics showed flat-line performance.

South/Central America’s estimated retail sales were up 2.5 percent over 2021 at $22.1 billion with a regional CAGR of 3.1 percent.

Individual country market statistics are: Brazil ($7.4 billion, 4 percent of global market, -0.2 percent CAGR), Mexico ($5.9 billion, 3 percent of global market, 0.8 percent CAGR), Colombia ($2.3 billion, 10.5 percent CAGR), Peru ($2.1 billion, 0.2 percent CAGR), and Argentina ($1.9 billion, 65.3 percent CAGR). Inflationary economies like Argentina typically report restated data later in the year.

Cosmetics and Personal Care products once again dominated regional sales at 57 percent, but continued trending slowly downward since 2017’s 67 percent high. Wellness ranked second at 17 percent, while Clothing and Accessories slotted third at 11 percent. Independent representative numbers declined by some 700,000 in 2022, reported at nearly 14.2 million.

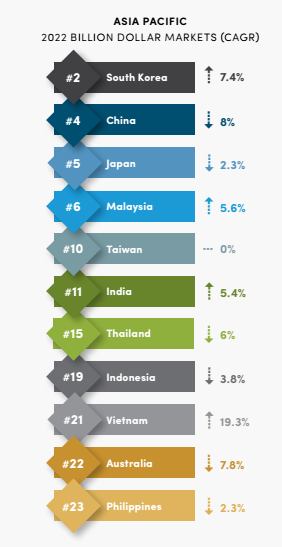

ASIA/PACIFIC

Eleven Billion Dollar Markets are located in the Asia/Pacific region and comprise 41 percent of the global retail sales for 2022. $71.5 Billion in estimated retail sales were generated in 2022, representing an increase of 0.2 percent. While static in nature, this growth represents the first regional increase in five years, when Asia/Pacific boasted 48.7 percent of global retail sales. The region’s overall growth remains negative at 1.7 percent for 2022.

More than 6.5 million independent representatives left the ranks of direct selling companies in 2022, but 67.6 million remain affiliated and sell primarily Wellness (42 percent) products. Cosmetics and Personal Care (21 percent) and Household Goods and Durables (20 percent) are also popular.

As in years past, China continues to impact Asia/Pacific’s regional statistics due to its population size, turbulence in the direct selling marketplace and post-pandemic recovery. For the fourth consecutive year, China’s estimated retail sales have fallen year-over-year. Down 8 percent, China posted $15.8 billion in sales in 2022, representing a compression of more than 40 percent since 2018 when the country seemed poised to overtake the number one ranking of Billion Dollar Markets. It remained fourth for the second year with a CAGR of -13.6 percent. Independent representative numbers fell slightly below 3 million.

A newcomer to the Billion Dollar Markets list last year, Vietnam showed its strength with a fifth year of double-digit growth and ranked 21st. Vietnam produced estimated retail sales of $1.2 billion in 2022 and reported a CAGR of 19.3 percent.

The Asia/Pacific market is enormous and intricate in nature, thus innately volatile due to cultural, environmental and governmental differences. For example, China’s continued descent contrasts sharply with significant growth in country markets like India, South Korea, Malaysia and Vietnam. Smaller emerging markets like Kazakhstan and New Zealand, not members of the Billion Dollar Markets List, are also increasing sales. In fact, Asia/Pacific was the only regional market worldwide that experienced growth, albeit a slight 0.2 percent, in 2022.

South Korea’s 2022 sales growth led the Asia/Pacific market at 7.4 percent and generated $18.5 billion in sales, which solidified their second ranking on the Billion Dollar Markets List. India’s growth of 5.4 percent has normalized and represents the fifth consecutive year of expansion. Malaysia came on strong generating $8.6 billion in sales, 5.6 percent year-over-year growth and a 9.8 percent CAGR. After a rebound year in 2021, Australia lost ground dropping 7.8 percent. Japan and Thailand are in decline, as are The Philippines and Indonesia. Taiwan posted flat figures in 2022.

Asia/Pacific Billion Dollar Markets data reports as follows: Australia ($1.2 billion, 1 percent CAGR), China ($15.8 billion, 9 percent global market share, -13.6 percent CAGR), India ($3.2 billion, 13.3 percent CAGR), Indonesia ($1.4 billion, -2.2 percent CAGR), Japan ($11.6 billion, 7 percent, -3.6 percent CAGR), South Korea ($18.5 billion, 11 percent, 5 percent CAGR), Malaysia ($8.6 billion, 5 percent, 9.8 percent CAGR), Philippines ($1.2 billion, -5.1 percent CAGR), Taiwan ($4.6 billion, 3 percent, 3.1 percent CAGR) and Thailand ($2.3 billion, -5.1 percent CAGR) and Vietnam ($1.2 billion, 19.3 percent CAGR).

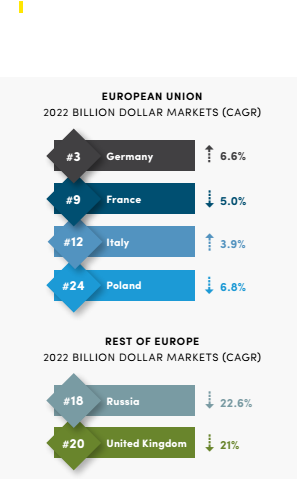

EUROPEAN UNION & THE REST OF Europe

The whole of Europe is responsible for 20 percent of global direct sales. This includes countries inside and outside the European Union. Six countries qualify as Billion Dollar Markets. Europe experienced a decline of 1.1 percent in 2022 with estimated retail sales of $34.7 billion and a regional CAGR of 1.6 percent.

2022 statistics show 12.6 million independent representatives, a drop of just over three million since 2021. Of those, 6 million reside within the European Union and 6.5 million in the Rest of Europe. By category, 18 percent of products sold in Europe are designated Wellness (15 percent, EU); Cosmetics and Personal Care (15 percent, 12 percent EU); Home Improvement (13 percent, 14 percent EU); and Household Goods/Durables (12 percent, 13 percent EU).

European Union

France, Germany, Italy and Poland comprise the EU Billion Dollar Markets and reported $30 billion in estimated retail sales for 2022, an increase of 1.8 percent. The subregion has a CAGR of 1.6 percent.

The news was good out of Germany and Italy, reporting gains in 2022. Germany led 6.6 percent year-over-year, posting $18 billion in estimated retail sales and establishing a CAGR of 3.1 percent. At $2.9 billion in sales, Italy’s year-over-year increased 3.9 percent with a CAGR of 1.2 percent.

France and Poland did not fare so well in 2022, suffering declines of 5 percent and 6.8 percent, respectively. France reported sales of nearly $4.6 billion with a CAGR of -2 percent, while Poland sales dropped to $1 billion they hang on to a positive CAGR of 2.8 percent.

Rest of Europe

The outlook in the Rest of Europe is a mixed bag with Russia in decline by 22.6 percent in 2022, reporting $1.7 billion in estimated retail sales and a CAGR of -7.3 percent. But despite losses of 21 percent in the United Kingdom, they brought in $1.2 billion in sales for 2022 and hold tight to a 21.2 percent CAGR thanks to back-to-back years of growth in the pandemic era.

Product category reporting is unreliable for the Rest of Europe as a whole; however, 42 percent of Russia’s 3.9 million independent representatives sell Cosmetics and Personal Care products, while Wellness is the focus of 37 percent. United Kingdom reports 46 percent Wellness and 40 percent Cosmetics and Personal Care. There are just over 400,000 independent representatives affiliated with direct selling companies in the UK.

About the Research

THIS COLLABORATIVE, GLOBAL DATA COLLECTION EFFORT of the World Federation of Direct Selling Associations and local direct selling associations and their member companies around the world, depicts the state of the global direct selling industry for 2022.

This is a collection of individual market data in local currency figures, which are converted into US dollars using current year constant dollar exchange rates to eliminate the impact of currency fluctuation. All statistics are based on estimated retail sales and in some instances may be restated using actual sales data as they become available. Statistics for some markets represent direct selling association member companies only and not the entire industry in that country. Other statistics are WFDSA research estimates. All statistics expire June 2024.

WFDSA Stats reported compilation of data takes more than 5,000 person hours to complete with independent third party vendor, Paul Bourquin of The Cadmus Group, responsible for direct contact between DSAs/member companies handling the data to ensure it remains completely confidential. Without strict confidential protocols, none of this work would be possible.

Want to Know More? You can read the full report.

From the October 2023 issue of Direct Selling News magazine.