The post Capitalizing on the Gig Phenomenon first appeared on Direct Selling News.

]]>Jazz era musicians may have coined the phrase “gig†when they raised their instruments at speakeasies, but getting paid on a per-job basis for part-time work wasn’t new then, and it isn’t new now.

The laundress who took in wash over a century ago. The kid mowing yards all summer. The freelance consultant doing taxes on the side. The temp employee filling a short-term manufacturing job—it’s all gig work.

Gig work quietly churned as barely decipherable economic white noise for decades. Its financial impact for workers was real and put food on the table and plumped rainy day savings. But it took technology—specifically the internet—to supercharge, modernize and legitimize gig work, ultimately creating the gig economy.

Early internet-based, tech-platform driven companies like Uber and Lyft, that disrupted the traditional transportation model by engaging people from all walks of life and enticing them to earn money using underutilized assets they already owned, sparked a phenomenon that’s grown to engage 60 million people.

To get here, modern gig workers transported not only people, but dinner, groceries and whatever else they needed from a retail store to their home. The COVID-19 pandemic shut things down; workplace behavior and locations changed; and the population grew increasingly mobile—all of which catapulted the popularity of gig work.

Today, the gig economy is an umbrella term broken into subsets like “sharing economy,†“on-demand economy†and “platform economy.†It’s a channel mechanism that effectively and efficiently links gig workers and customers.

And it is BIG! It’s economic estimate is $1 trillion annually in the U.S. with an average growth rate of 16-17 percent (aggregated consensus from multiple sources). Projections say 100 million gig workers will pursue primarily part-time income using pay-for-performance criteria by 2027.

But to be clear, gig workers certainly aren’t just shuttling people to the airport or delivering dinner any longer. They likely never were.

“The gig economy is very broad, and that’s one of the reasons why we feel it behooves study. Because sometimes we think we understand, but there’s so much more to it,†John Fleming, long-time advocate of the direct selling industry, author and founder of the Ultimate Gig Project, shared.

Fleming and Dr. Robert A. Peterson, a former Vice President of The University of Texas at Austin, who holds the John T. Stuart III Centennial Chair in Business Administration and served on an advisory committee to the U.S. Census Bureau, set out to uncover more about the gig economy. Their efforts, The Future of Work: Insights Into the 2023 Gig Economy Workforce, are available now.

Who is in the Gig Economy. And Why.

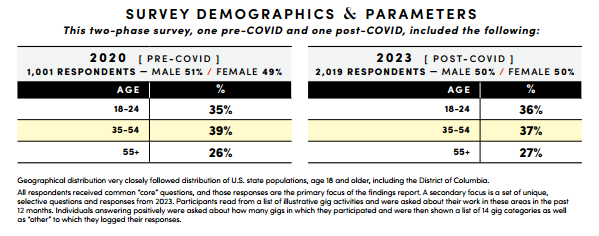

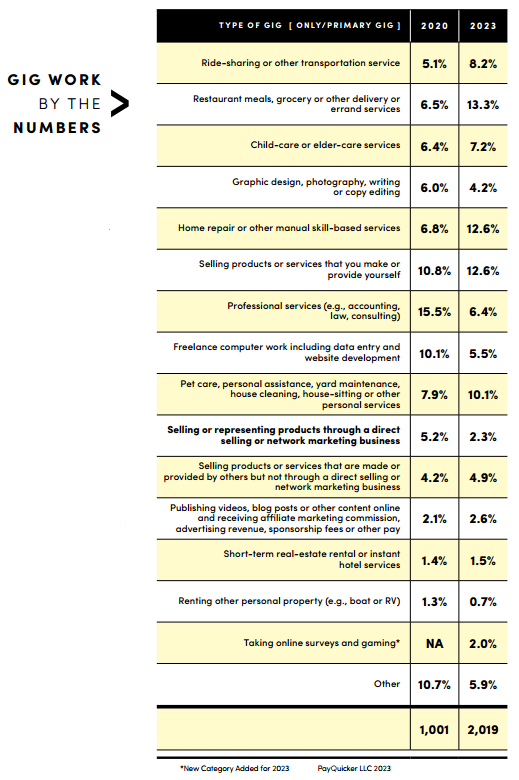

Two surveys of self-identified gig workers—conducted by the Ultimate Gig Project, the first in 2020, pre-pandemic with 1,001 respondents and the second, post-pandemic in 2023 with 2,019—offer insight into the worker pool’s diversity; the work they perform; and their earnings expectations and spending habits. Linear trends have emerged showing the diverse nature and rapid growth of the gig economy itself, which have major implications for business, government and society.

This is the only known gig worker study—stretching beyond very defined subsets, like Uber, Lyft or 1099 workers—to include multiple categories within the gig economy. Additional surveys are expected in late 2024.

“When we do research, we are not trying to provide answers as much as we are attempting to stimulate thinking,†Fleming explained. And The Future of Work: Insights into the 2023 Gig Economy Workforce gives the direct selling industry a great deal to mull over.

So, who are the gig workers leading this gig economy? What do they do and what do they want? And how might direct selling best capitalize on this phenomenon?

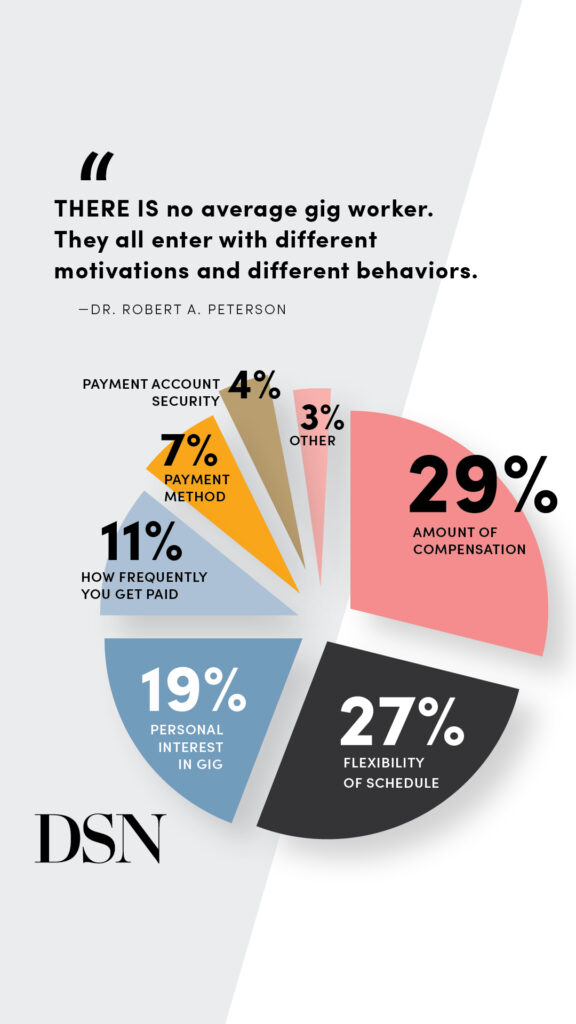

“There is no average gig worker. People talk about the economy. Yes, it’s out there. It’s a trillion dollars. Yes, we’ve got 60 million people, but there’s no average gig worker. They all enter with different motivations and different behaviors, so there are different subsets. They’re in there for different reasons,†Dr. Peterson said.

The youngest gig workers, 18-34, are doing deliveries, earning extra spending money. Household bills may not be a priority for their paychecks. But those midlife gig workers, 35-54, now rely on gig work to meet household bills. And that’s a definite change since 2020, when most gig workers socked earnings away for retirement, savings or investments. The over-55 group tends to like their gig—so they stay with it. For them, it may be less about the money and more about staying active.

Gig workers report satisfaction with the flexibility and freedom associated with the work as well as the pay, reporting that earnings exceeded their expectations upon entering the workforce. And they tend to stick around, too.

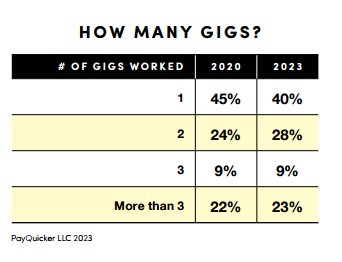

The starkest change between 2020 and 2023 was in the number of gigs in which these workers participate. One was enough three years ago, but today it’s common for people to participate in multiple side hustles, while maintaining a similar number of work hours. Food delivery gigs have nearly doubled. This indicates a change in the structure of the gig economy, as well as an opportunistic work force. The norm is now three or more gigs.

Sixty percent of people now work multiple gigs, which Fleming said is likely the result of a couple things: mastering the work and wanting more of it or branching out to similar work because they have flexibility and freedom.

While gig economy predictions get dicey, today’s reality is that people continue to join its ranks. But Dr. Peterson warns that current growth rates cannot go on forever.

“Just mathematically, as it grows bigger, it’s got to also grow slower. Because there’s a limit in terms of the number of people that are out there in the population. So, if you look at a cap of 100 million people as potential gig workers (2027 projection), that might be it. And when we get to that, we’ll see a plateauing in terms of growth.â€

Capitalizing on the Gig Work Phenomenon

This seems to indicate a timeliness factor associated with how best to utilize gig workforce data within the business world and inside the direct selling industry.

“Choice is prevalent, and there are so many choices out there. It’s one of the things that we should pay attention to because the traditional, industrial-economy work ethic has changed, and employers are finding it more and more difficult to get people into a nine-to-five job. Flexibility and freedom are new choices, and people are going to continue to look at those choices,†Fleming explained. “Direct selling practitioners really need to pay attention to that because it might lead to redefining how and what we offer.â€

For years, the direct selling industry has watched the gig phenomenon grow, believing that direct selling was something more than a gig—which it arguably is. But misunderstandings about the breadth and depth of the gig economy may have stopped direct selling’s decision makers from fully capitalizing on the gig work phenomenon. After all, today’s gig worker, as defined by this new research, could be direct selling’s newest prospect.

In the 2020 survey, six percent of self-identified gig workers declared themselves to be direct sellers. That number is now down to three percent. Why?

“From our point of view, direct selling is a subset of the gig economy. So, it’s not a matter of should direct sellers become gig workers? They are gig workers. If you look at the broader definition, the gig economy includes independent contractors in many different formats. But sometimes we narrow that definition too much in accordance with our own perception,†Fleming said.

Direct selling’s biggest challenge may be in positioning itself as more relevant in the marketplace. The industry offers extraordinary products and services, but relevance is also about perception. And that, Fleming believes, is the industry’s big opportunity.

Firms like Upwork are growing because people from all walks of life are looking to be in more control of their work. That mirrors direct selling. But would these Upwork gig workers—who prioritize flexibility and freedom—really respond to “career†pitch messaging? Do self-defined gig workers want a “career� Could direct selling’s “career†messaging need an update to attract a new kind of prospect?

Relevancy. Fulfillment. Perception.

The gig economy has all but ignored career earnings talk. Yet it has given people who want to put in more time the ability to earn more. The satisfaction rate is high among gig workers. People love what they do and there is no over promise.

Less than 10 percent of gig workers are interested in career-type incomes, which start roughly at $2,000/month. A great percentage are satisfied with $300, $400 or $500 per month, so long as they are able to work when and how they want.

And with technology making it much easier for people to do so many things in the gig economy, why shouldn’t direct selling be one of those gigs? Could it be time to shake out the complexities and multiple gig restrictions in direct selling and simplify?

“If we believe we’re that good—and I certainly think we are—then perhaps we need to look at repositioning our proposition—maybe speaking a little differently about who we are and what we do as well as taking steps to eliminate the adversarial attitudes that many segments have for the way we conduct business,†Fleming said. “The gig economy doesn’t make promises. They basically offer you a possibility, and then you become engaged. Then they reward you on performance. It’s really up to you. If you do the work, you’re going to get paid. And this gig economy has triggered how we think about all forms of work.â€

And it’s that type of wide-spread disruption that creates opportunity for the direct selling industry. Direct sellers could argue that they were the first gig workers. On paper, the “whyâ€s of so many direct sellers—flexibility, time freedom, earnings potential—read like a gig work must-have list.

To be the best at customer acquisition and retention in a marketplace that demands it, yet failing to compellingly convey that story—when there’s so much potential—is a contradiction and challenge worth exploring. If direct selling, as a subset of the gig economy, can simplify and easily show gig prospects the aggregate benefits from the customers they help influence and acquire who then continue to purchase the products, it can only gain ground.

“We have so much room to improve and position ourselves, so the public—the marketplace if you will—can better understand who we are; what we do and how much we have to offer,†Fleming said.

Defining the Gig Economy and Its Participants

Growing four times faster than the traditional economy, gig work and gig workers are evolving. The desire for flexibility and freedom is strong and new research indicates the only real commonality is the need for more money.

The Future of Work: Insights into the 2023 Gig Economy Workforce provides a glimpse at a diverse and ever-changing worker group. Here are some key points to ponder from that recently published research.

- No specific gig activity dominates the gig economy. Fewer than 1-in-12 pursued a platform-based ride sharing gig in 2023.

- Online platform-based gigs are just one segment, despite attracting the majority of media attention.

- Female gig workers expect to earn less than their male counterparts (and do). The underlying reasons are numerous, complex and explainable.

- Despite the need for more money, a not insignificant proportion of the gig workforce engages for reasons not associated with pay.

- There is little distinction between primary and secondary gigs for those who pursue multiple gigs in terms of the nature of the gig, time spent or earnings received.

Want to learn more? View the full report, sponsored by PayQuicker.

What You Should Be Asking Yourself and Your Team

1/ What does work look like in the future? Flexibility and freedom have a lot to do with how people want to live and relate to their families. How might direct selling better meet societal expectations and change?

2/ The gig economy is a phenomenon that doubled between 2018 and 2023. Why has the gig economy outpaced direct selling since 2015?

3/ Gig workers are average Americans. Who they are; how they participate; how many gigs they work; their earnings expectations; and how they spend their money can influence how direct selling companies recruit them. Should direct selling modify its messaging? If so, how?

4/ Why do 60 percent of gig workers participate in multiple gigs? They pursue flexibility, freedom, work/life balance and earnings to meet household expenses. Can direct selling help meet their needs?

5/ Direct selling is a subset of the gig economy but captures only three percent market share. How might direct selling improve and position itself to gain market share? Is it worth it? Can direct selling simultaneously offer gig work and a career opportunity?

From the September 2023 issue of Direct Selling News magazine.

The post Capitalizing on the Gig Phenomenon first appeared on Direct Selling News.

]]>The post The Inflection Point first appeared on Direct Selling News.

]]>Letting go of what was and doubling down on what’s next.

We’re experiencing a return to normal. Does this phrase sound familiar?

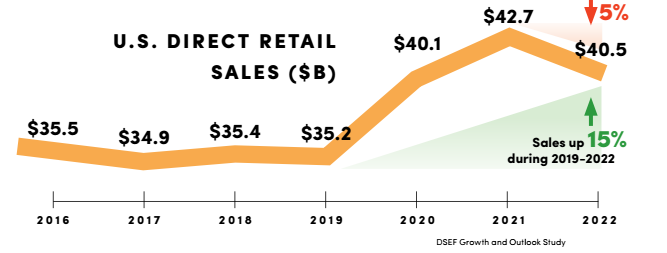

The pandemic brought an unexpected boom to the direct selling industry. Many companies saw revenue increases and incredible growth. As the pandemic has eased, so too has that explosive growth. Only 18 companies made our 2023 list of companies who experienced three consecutive years of revenue growth. And overall, the industry saw the beginning of a decline in total retail sales at the end of 2022.

It would be easy to assume that these numbers reflect a natural market correction—one that doesn’t signify a decline in progress or relevancy, but rather a return to pre-pandemic levels. After all, U.S. direct selling revenues reached $40.5 billion in 2022, which is a decline from 2021, but still a sizeable increase from $35.2 billion in 2019.

The problem with this theory is that consumer spending hasn’t followed this trajectory. In July, Deloitte released its State of the U.S. Consumer report, revealing that retail sales were up 31.6 percent from pre-pandemic levels and non-store sales were up 69 percent. Consumers are buying—particularly in discretionary categories—so why aren’t direct selling revenues reflecting that boost?

As the research shows in The Future of Work: Insights into the Gig Economy Workforce, the gig economy is growing four times faster than the traditional economy. However, the number of gig workers representing direct selling has decreased from 5.2 percent to 2.3 percent. The DSEF Growth and Outlook Study shows an eight percent decline in the number of direct sellers in 2022.

At Direct Selling News, we believe the direct selling industry is in, perhaps, one of the most important Inflection Points in its entire 100+ year history. The term inflection point originated as a mathematical description depicting that moment when the curve of a graph changes direction moving up or down. A point when business leaders must proactively address the future of their brands and the relevancy they bring to market.

What we are experiencing is not a return to normal; it’s a critical moment to address the channel’s strengths and opportunities to evolve forward. A time to determine if next year’s P&L sheets will reflect a positive shift in momentum or another year of steady decline?

DSN worked closely with channel advisors, executives and analysts, compiling five strategies to help companies understand the current state of their business so they can more effectively position themselves for growth.

We must be candid and honest about where the channel has been and is. The so-called normal of 2019 doesn’t exist anymore. This is a critical moment in time where companies have two choices. Stay in a state of comfort and complacency and expect similar results. Or, let go of what was and move forward with open, innovative minds and embrace evolution to build for the future.

Ultimately, the choice is yours. But the time has come to make that choice.

1Â /Â Dig into the Data

It’s time to take a brutally honest look at the statistics surrounding the last few years. The drastic bump that most of the industry enjoyed during 2020 and 2021 was not typical, nor does it appear to be continuing. Allowing this data set to incorrectly inform future projections and strategies prevents companies from reaching their full potential.

It is imperative that companies dig into their historical information to genuinely understand the impact the pandemic had on their most important statistics. The priority must be to look for trends that indicate future habits; identify key patterns; and discover exactly what behaviors your fields are engaging with today—successfully and perhaps not-so successfully.

2 / Avoid Being a Regulatory and Compliance Target

The channel has to work together. Clean, simple and transparent are the obvious antidotes to a tough regulatory environment, but no one company or brand can turn the tide in the industry’s favor to heal decades of reputational damage.

“We have got to make ourselves unimpeachable,†said Heather Chastain, Founder and CEO of Bridgehead Collective, a consulting firm for the direct selling industry. “You don’t have to be a bad actor in the channel to gain a bad reputation. Take a look at the transparency of your programs, incentives and compensation plans and eliminate any loopholes or obfuscation. We have to be on a mission for transparency.â€

Larry Steinberg, chair of the Buchalter Law Firm’s MLM Practice Group agreed, “Now is as good a time as ever to refocus your business plan on retail sales, a robust preferred customer program and communications with your field about the importance of compliance. There is ongoing rulemaking activity in the business opportunity, earnings claim and restrictive covenant areas. Staying under the radar is becoming increasingly more difficult, and the stakes are higher than ever.â€

Eliminate hidden fees. Make it simple to opt out of an auto-ship agreement. Communicate with the field about the importance of compliance. Use dollar amounts instead of points to pay commissions and achieve bonuses. Do whatever it takes to communicate that your product and opportunity can withstand a critical eye. When in doubt, choose transparency.

3Â /Â Understand Changes in the Marketplace

Today, customers want a seamless shopping experience that is transparent from end-to-end. They want to engage with companies who deliver on their promises with little-to-no barrier to entry, frictionless experiences, minimal clicks, streamlined shopping cart processes and reward incentives that are attainable and delightful. If there are 17 hoops to jump through to get the prize, you’ve missed the point—and you’ve likely lost a loyal customer.

Zooming out a bit, digital fluency is crucial. Consumers, particularly younger generations, expect everything from first impressions to shopping, purchasing and delivery, to have a simple, yet impressive, responsive digital component. The way people buy is now staggeringly influenced by a brand’s digital footprint, even if they ultimately buy in person or in a retail environment.

Shoppers are still spending, but only where and how they want to shop. The direct selling product and customer proposition must be on point and at the same level or greater than massive online platforms like eBay and Amazon.

The growth of ecommerce is proof of the concept that people are shopping differently. The growth and use of the digital platform provides an opportunity to compete with any brand, at any time, through people who love what they are experiencing and desire to share with others what was shared with them.

Make sure your products and platform serve today’s customer in meaningful, memorable ways that will make them want to come back time and time again—and bring their friends along with them.

4Â /Â Challenge Old Mindsets

For decades, the direct selling industry has positioned itself as a massive, team-building opportunity. Marketing messages traditionally lauded the six-figure earner, the luxury car bonus and a certain lifestyle to spark interest. Not so much today.

“Gen Z and Millennials don’t respond to that like generations before them did,†Chastain said. “They are more interested in making an extra $250 or $500 a month to supplement additional income streams and rarely have an interest in building a downline, much less lead a team.â€

Chastain and her company Bridgehead Collective recently released a first-ever research study conducted with Jason Dorsey on the impact of Gen Z and Millennials on the marketplace including specific implications for direct selling.

Businesses and brands are more than their compensation plans, but it’s imperative to analyze whether the incentive and payout structures in place are truly meeting consumer and distributor demands. Take a deeper look at the touchpoints that could move customers from casual purchasers to loyal repeat buyers.

Direct selling companies should be thinking of themselves as brands first. If you still think your compensation plan is the most important way you can attract new customers and prospective independent contractors to your company, it may be time to change your mindset and the language you use to position yourself in the marketplace.

5Â /Â Be Mindful of Chasing Trends

Identify what needle you’re trying to move and then put straightforward, clear strategies in place to deliver those results.

“Be really thoughtful about the buzzwords you use to describe your strategic decisions,†Chastain said. “Some companies are saying they are jumping on the affiliate trend, but are they really? Or are they just simplifying the front end of their compensation plans?â€

Consider how your culture supports ordinary people who want to participate in your company’s unique niche and mission. Grow your customer base to boost revenue, rather than investing in a few top team-building leaders. And—above all else—cultivate a brand identity, shopping experience and product story that sparks love, loyalty and longevity in the hearts of shoppers.

Straightforward Strategies Win

There appears to be a clear direction that industry analysts and experts agree will move the channel in the right direction: streamlined, transparent operations focused on selling quality, high-value products and services.

A focus on the fundamentals of brand building means a focus on everything—not just commissions or compensation plans, but incentives, recognition, gifts—everything. If that sounds like it might dig into the bottom line, that’s because it likely will. But the payoff, Chastain says, is well worth it.

“Find profitability elsewhere,†she said. “The dated approach to compensation plan design may be costing the company too much as it attempts to be relevant in a very different marketplace. Refocus your energy on delivering quality content. Be ruthless with the products that earn a spot in your lineup. When you focus that kind of efficiency within your company, it will free up the few margin points you need to support a simple, generous combination of commissions, incentives, recognition and community for affiliates, distributors and customers.â€

A lot has changed since early 2020. Smart and strategic companies aren’t focusing on what they see in the rear-view mirror. They are focused on the road ahead—what’s working today and how to build for the future.

Believing that the industry’s recent dip in overall numbers is simply a “return to normal†means buying into a strategy of a pandemic era when nothing was truly normal—not the economic landscape, not shopping habits, not everyday life.

We can all agree that there will be geopolitical challenges domestically and globally as we move forward. But in spite of those uncertainties, direct selling decision makers must look to the future based solely on current market conditions and best practices, free from outdated models, ideals and traditions.

As company leaders prepare to make strategic plans for 2024, they will have to decide if this will be the year the direct selling industry participates in an evolution that will make it more relevant and accessible for the months, years and decades to come.

From the September 2023 issue of Direct Selling News magazine.

The post The Inflection Point first appeared on Direct Selling News.

]]>